does tennessee have inheritance tax

There are NO Tennessee Inheritance Tax. IT-11 - Inheritance Tax Deductions.

What You Need To Know About Tennessee Will Laws Probate Advance

For deaths occurring in 2016 or later you do not need to worry about Tennessee inheritance tax at all.

. The inheritance and estate taxes wont be a concern of Tennessee residents who dont own or inherit the estate in other states or whose estate does not go anywhere around the lifetime exemption of 1206. Until this estate tax is phased out the minimum tax rate for estates larger than the exemption amount is 55 and the maximum remains 95. As of December 31 2015 the inheritance tax was eliminated in Tennessee.

For 2021 the exemption in set at 117 million per individual and it is set to increase in 2022 to probably close to 12 million. For example if a Tennessee resident receives in Heritance from someone who. Under Tennessee law the inheritance tax was actually an estate tax a tax that was imposed on estates that.

Tennessee does not have an inheritance tax either. Inheritance Tax in Tennessee. Tennessee is an inheritance tax-free state.

However it does have an estate tax. Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now. However there are additional tax returns that heirs and survivors must resolve for their deceased family members.

The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax. However if the value of the estate is over the exempted allowance for a particular year the tax rate ranges from 55 at the lowest end to 95 at its highest end. IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Tennessee Resident.

There is a 1170 million exemption for the federal estate tax. Tennessee is an inheritance tax and estate tax-free state. Only those estates that are valued 5 million or more are subject to the Tennessee estate tax.

Tennessee does not have an estate tax. The following is a description of how the tax worked for deaths that occurred prior to 2016. The inheritance tax is levied on an estate when a person passes away.

Ad Download Or Email TN INH 302 More Fillable Forms Try for Free Now. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. For any decedents who passed away after January 1 2016 the inheritance tax no longer applies to their estates.

Not many Tennessee estates have to pay the estate tax because the state offers a generous exemption for deaths occurring in 2015. It is one of 38 states with no estate tax. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply.

It is possible though for Tennessee residence to be subject to an inheritance tax in another state. It allows every Tennessee resident to reduce the taxable part of their estate gifting it away to the heirs 16000 per person every year. Only seven states impose and inheritance tax.

What is the state of Tennessee inheritance tax rate. For example the neighboring state of Kentucky does have an inheritance tax. Kentucky for instance has an inheritance tax that applies to all property in the state even if the person inheriting it lives elsewhere.

No estate tax or inheritance tax. Tennessee used to impose its own estate tax which it called an inheritance tax This tax ended on December 31 2015. Select Popular Legal Forms Packages of Any Category.

There is a chance though that another states inheritance tax will apply if you inherit something from someone who lives in that state. What is the state of Tennessee inheritance tax rate. All Major Categories Covered.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

The Federal estate tax only affects02 of Estates. All inheritance are exempt in the State of Tennessee. However if the value of the estate is over the exempted allowance for a particular year the tax rate ranges from 55 at the lowest end to 95 at its highest end.

Some examples of tax returns involve final individual federal and state income tax returns federal estate income tax returns that are due by April 15 of the year following the persons. In 2012 the Tennessee General Assembly chose to phase out the states inheritance tax over a period of several years. Up to 25 cash back Update.

It has no inheritance tax nor does it have a gift tax. For any decedents who passed away after January 1 2016 the inheritance tax no longer applies to their estates. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706.

IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Non-Tennessee Resident. How much is tax free inheritance in Tennessee. Even though this is good news its not really that surprising.

For all other estates subject to the inheritance tax for deaths that occurred before December 31 2015 the inheritance tax is paid by the executor. IT-12 - Inheritance Tax Deduction - Real Property Sale Expenses.

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Market Inheritance Tax Retirement Strategies Tax

Tennessee Estate Tax Everything You Need To Know Smartasset

Tennessee Estate Tax Everything You Need To Know Smartasset

How To Get A Marriage License In Tennessee Zola Expert Wedding Advice

Tennessee Last Will And Testament Template Download Printable Pdf Templateroller

Tennessee Health Legal And End Of Life Resources Everplans

Divorce Laws In Tennessee 2022 Guide Survive Divorce

Tennessee State Economic Profile Rich States Poor States

Tennessee Taxes Do Residents Pay Income Tax H R Block

Graceful Aging Legal Services Pllc

2013 2022 Form Tn Rv F1400301 Fill Online Printable Fillable Blank Pdffiller

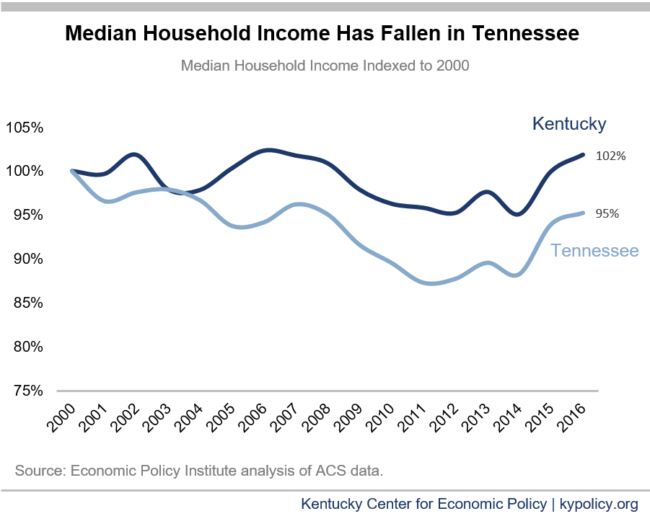

Shifting To A Tennessee Like Tax System Would Harm Kentucky Kentucky Center For Economic Policy

Do You Need A Tax Id Number When The Trust Grantor Dies Probate When Someone Dies Last Will And Testament

Historical Tennessee Tax Policy Information Ballotpedia

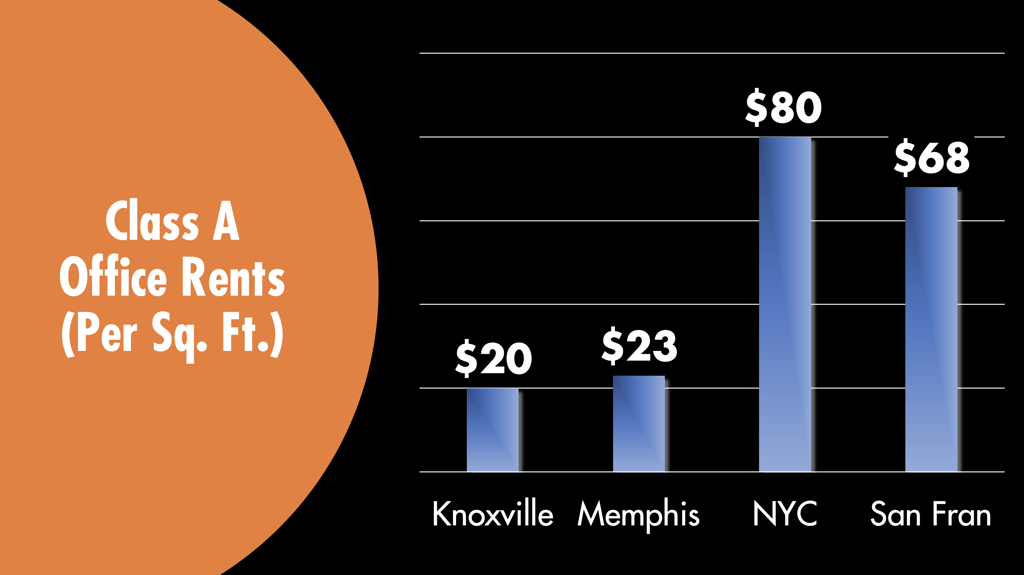

The Pros And Cons Of Locating Your Business In Tennessee

Tennessee Retirement Tax Friendliness Smartasset

Probate Fees In Tennessee Updated 2021 Trust Will